As a general rule, high-quality fixed income investments tend to do well when stocks take a big tumble. Interest rates usually fall when equities are weak, and this provides a lift to bond prices.

Alas, it’s only a general rule. And with all general rules in life, there are exceptions.

This year is a case study in how stocks and bonds can sometimes head south together. Rather than playing an offsetting role for a portfolio, fixed income loses ground, too.

What Has Happened is Historically Rare

It’s difficult to understate just how rare the combined underperformance of equities and fixed income truly is. As Bespoke Investment Group, a provider of investment insights and data recently wrote:

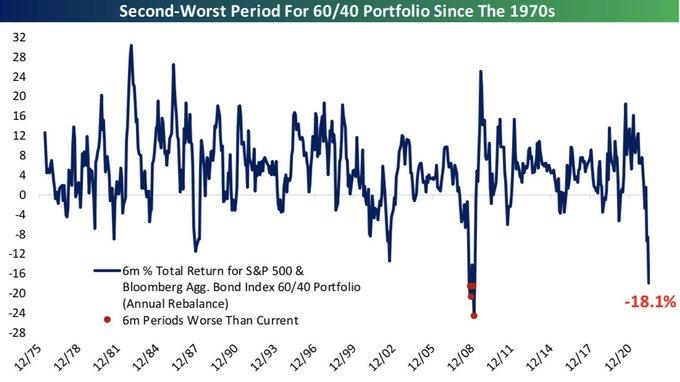

This has been the 2nd worst period for traditional “60/40” portfolios (60% stocks, 40% bonds) since the 1970s. Only the worst stretches of the Financial Crisis were worse.

Source: Bespoke Investment Group via Twitter

Explaining the Underperformance

Why have stocks and bonds fallen so much (and together)? In a nutshell, rising interest rates. Central banks (the Federal Reserve, the Bank of Canada, etc.) have turned very hawkish in a bid to quell the inflationary pressures that have emerged in the economy. These pressures are the result of soaring commodity prices, tight labour markets, and persistent supply chain issues stemming from the pandemic.

Raising rates is bearish for bond prices, as the two move inversely to one another. As rates go up, bonds fall. This is especially true for longer-term bonds, as we discussed in a previous post on duration. Simply put, an interest rate increase of 1% will hurt a 10-year bond far more than one of a much shorter maturity.

But rising interest rates haven’t just been bad for bond markets. They’ve also spooked equities. Among other factors, investors are worried that central bank rate hikes will end up tipping economies into recession as a side effect of fighting inflation. That’s sent growth stocks, in particular, tumbling.

This Too Shall Pass

As painful as this stretch has been for investors, it’s reasonable to believe there’s light at the end of the tunnel:

- As the above chart indicates, the decline in the classic 60/40 portfolio is almost unprecedented. Each time it’s fallen sharply over history, it’s recovered nicely.

- Higher interest rates have hurt bond prices, but there’s an upside: Investors can finally earn a decent yield from fixed-income securities. Since the financial crisis, the majority of the return on bonds has come from capital appreciation, not interest payments. That seems to be changing, and is good for investors in search of decent, reliable yields.

- Much of the bad news on the equity side is likely priced in: With so much talk of a possible recession, many investors have already thrown in the towel. We can’t say for sure that the bottom is in, but there’s already a huge amount of negativity in the market. Huge declines don’t tend to happen when everyone is already so bearish.

Stay the Course

The worst time to abandon your long-term investment plan is when markets are a sea of red. It may be tempting to think that a diversified portfolio of stocks and bonds will no longer cut it, but history says you should stay the course. Better times will come. Why? They always have.