There’s a saying in the investment world: Your portfolio is like a bar of soap. The more you touch it, the smaller it gets.

Of course, some handling of an investment portfolio is advisable and won’t cause permanent shrinkage. If stocks go on a massive run, you will end up being underweight fixed income, so rebalancing is likely a smart move.

Nonetheless, the gist of the adage holds true: Trying to ‘beat the market’ with frequent trading is a fool’s errand for the average investor.

The Importance of Sitting Still

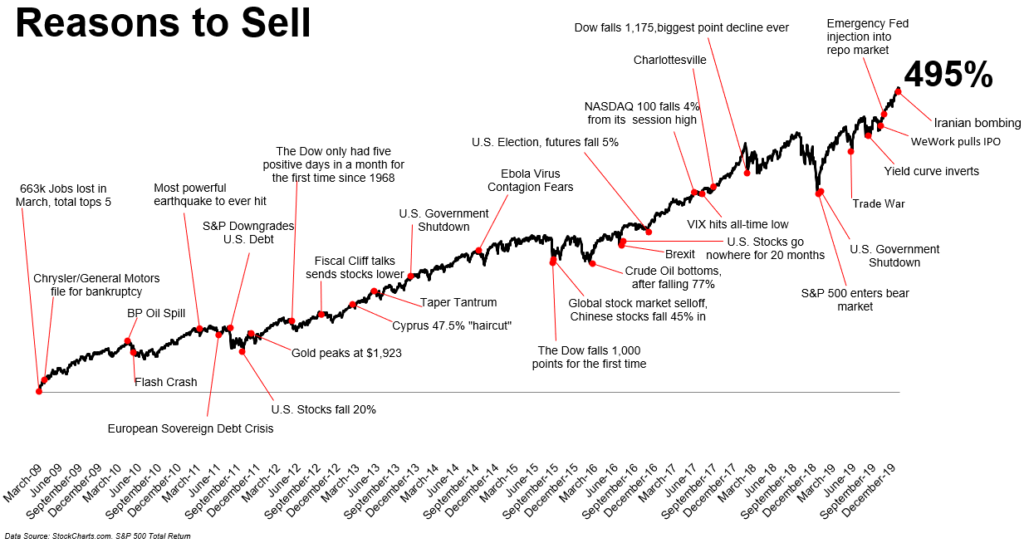

There’s a well-circulated chart of the stock market, created by Ritholtz Wealth Management in the U.S. The chart is annotated with all the potential reasons an investor could have sold in past years.

Source: Ritholtz Wealth Management

Another example? The pandemic. Stocks fell precipitously in the first quarter of 2020, but anyone who went to cash and stayed there missed one of the great bull runs of our time. That episode speaks to one of the problems with bailing on the stock market: Even if you time your sale well, the odds you’ll know when to get back in aren’t good.

Mind you, sitting still and not panicking is easier said than done. We are bombarded with reasons to sell every day. Whether it’s geopolitical fears, predictions of recession, or the failure of a financial institution, the news can make you believe your nest egg is about to be permanently scrambled.

One reason for this? As Michael Batnick of Ritholtz has observed, “bad news smashes your face against an amplifier, while good news just plays quietly in the background.” Or, as he quotes Bill Gates, a man who knows something about wealth creation: “Headlines, in a way, are what mislead you, because bad news is a headline, and gradual improvement is not.”

Another reason it’s so tempting to hit the sell button? Loss aversion. We are hard-wired to feel losses more than gains, and so fear of a market decline can lead investors to forget all the reasons to stick with their long-term plan. Perhaps, to build on a famous line from Franklin Delano Roosevelt, the only thing for investors to fear is fear itself.

Let the Market Climb the Wall of Worry

It’s said that bull markets climb a wall of worry. As stocks continue their ascent, disbelief is common, and doubt about the sturdiness of the market abounds. This saying refers to bull markets of the shorter-term variety, but the wisdom applies to much longer periods of time as well. Indeed, we would argue that the story of equities throughout history is one of a single large bull market, interrupted by disruptive corrections that shake out the weak hands.

The lesson? Over time, the market goes up. But to benefit from stocks’ tendency to rise as the decades go by, you must stay invested. And that means observing the wall of worry—all those reasons you’re told to sell—and sticking with your long-term plan instead.

One of the most difficult things to do as an investor is nothing. But the good news is, doing nothing (i.e. not panicking) has historically been the most rewarding course of action you can take.