-

What Guides Us

We are motivated by a profound desire to make our clients’ lives better. This is at the core of who we are and what we do. We believe we can improve your life through effective wealth management. To achieve this outcome, we focus on the following key principles:

- Provide Peace of Mind

- Build the Right Strategy

- Help Avoid the Big Mistake

- Maximize Tax Planning Opportunities

- Plan for the Expected, and the Unexpected

- Create Good Inheritors

-

Our Process

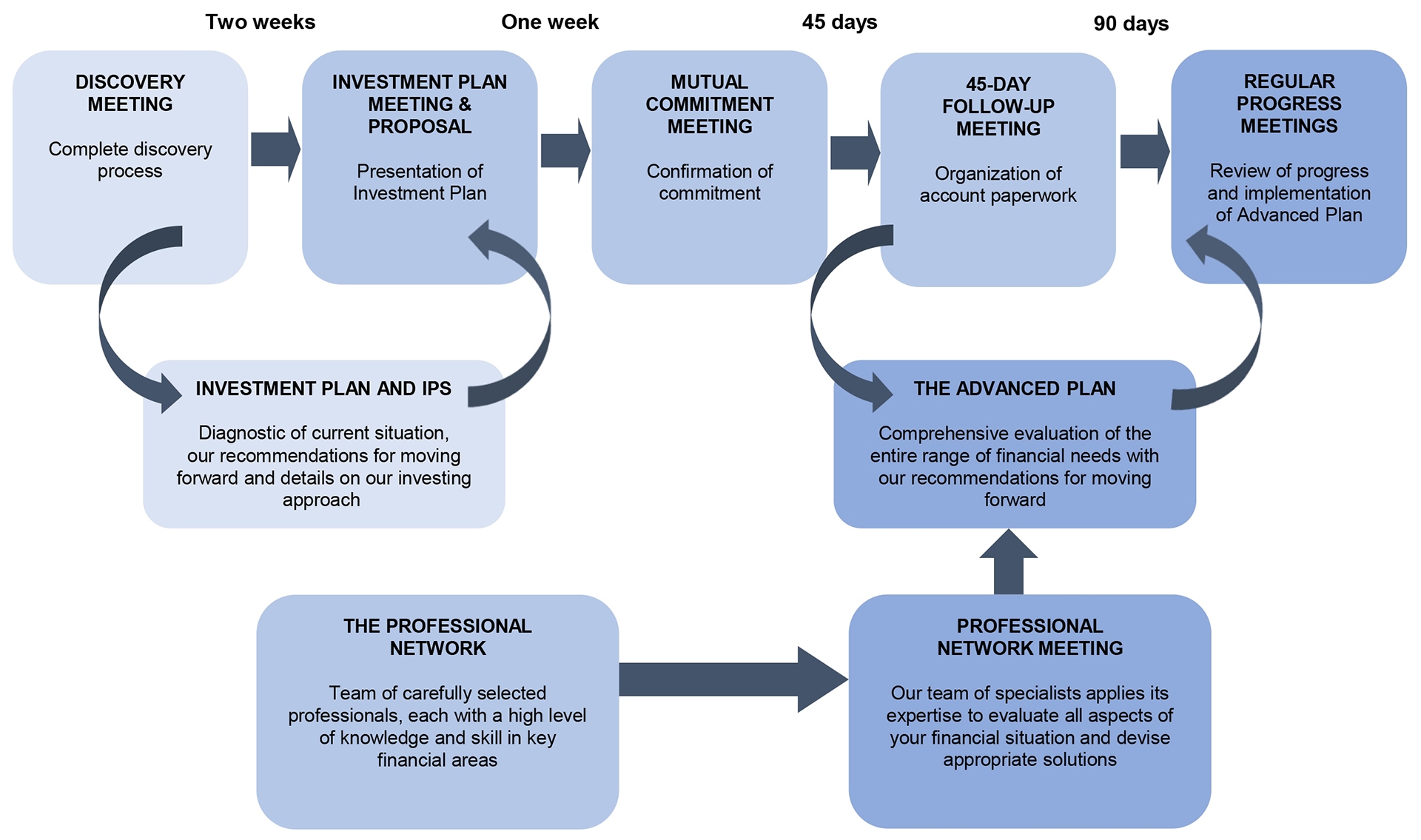

Our expertise lies in knowing what is most important to our clients and utilizing the skills of our Virtual Family Office network to proactively address all investment and advanced planning issues and opportunities. Whether it be preserving and growing the wealth you’ve built over time, mitigating tax, taking care of your heirs or maximizing your charitable intent, we put our team’s expertise into action.

Through our consultative process, including a deep discovery, we understand all areas of your life and what is most important to you and your loved ones. With your goals and a long-term plan in mind, we can take care of everything for you.

We’ve got you covered.

-

A Strategy for You

Strategic wealth planning is all about you. We sit down with you to talk about your current needs and your goals for the future. Then we formulate a plan to make it happen.

A component of this comprehensive plan will involve your investments. But strategic wealth planning is more than that: it’s also about what you want for your family, your business and your legacy.

Strategic wealth planning helps you minimize taxes so you can keep more of your hard-earned money. It can also maximize the impact of your generosity by giving wisely to your favourite charity.

-

We Use a Team Approach

When developing your customized strategic wealth plan, we believe a team approach is best. That’s why we’re proud to be able to draw on the knowledge and skill of our Virtual Family Office, consisting of our Expert Network and our internal Wealth Planning Group.

Whether it’s lawyers, accountants, investment analysts, tax professionals, elder care specialists or health specialists, we can offer sound guidance on practically any financial issue or question you may have.

With our experts behind us, we can deliver what you need most, an integrated Advanced Plan with all pieces talking to one another. We know that with the best advice, you are in the best position to achieve your financial goals. You deserve no less.

-

PLANNING TOOLS

Financial Snapshot

Provides you with a high-level overview of your financial resources and their ability to meet lifestyle objectives.Estate Plan

Provides a comprehensive analysis of your final intentions and offers suggestions about wealth transfer strategies, executor designations, and will specifics, all to ensure that your wishes are carried out upon death in a tax efficient manner.Financial Plan

A simple yet comprehensive picture of your current wealth scenario. This plan will provide clarity for the future and answer questions that may arise if your circumstances change.Wealth Planning Report

Comprehensive reporting process that addresses sufficiency of financial resources to support lifestyle goals and objectives and provides detailed, customized tax and financial strategies and wealth transfer strategies.

With access to a wealth of tools and resources, our Assante advisors and their clients are supported by the exceptional services of the Wealth Planning Group. The Wealth Planning Group is part of CI Private Counsel LP, a wholly-owned subsidiary of CI Financial Corp. (“CI”). The principal business of CI is the management, marketing, distribution and administration of mutual funds, segregated funds and other fee-earning investment products for Canadian investors through its wholly-owned subsidiary CI Investments Inc. If you invest in CI products, CI will, through its ownership of subsidiaries, earn ongoing asset management fees in accordance with applicable prospectus or other offering documents. Insurance products and services are provided through Assante Estate and Insurance Services Inc.